Sending money abroad used to be a complicated and expensive process. But now, thanks to the advent of online banking and money transfer apps, it’s easier. There are now so many options available that it can take time to know which is the best for your needs. So we’ve put together a list of the six most popular invest-and-transfer apps, ranked based on several factors.

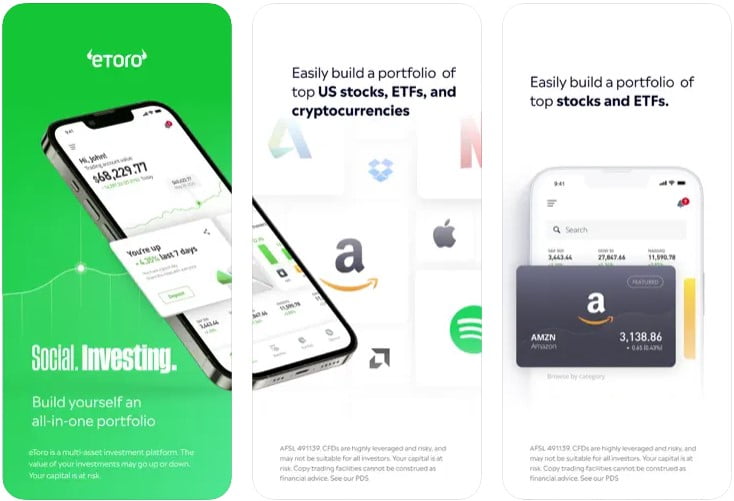

1. eToro

eToro is one of the most popular investment apps in the world. Users can invest in stocks, commodities, and currencies from their phones or computers. eToro also offers a unique feature that allows users to send money abroad without going through a bank.

When you use eToro to send money abroad, you are essentially using it as a middleman. You deposit your money into eToro’s account, and then they forward it to the recipient. This process can take minutes to days; here is more info on the currency transfer times. Fees for this service vary depending on how much money you are sending and which currency you are using.

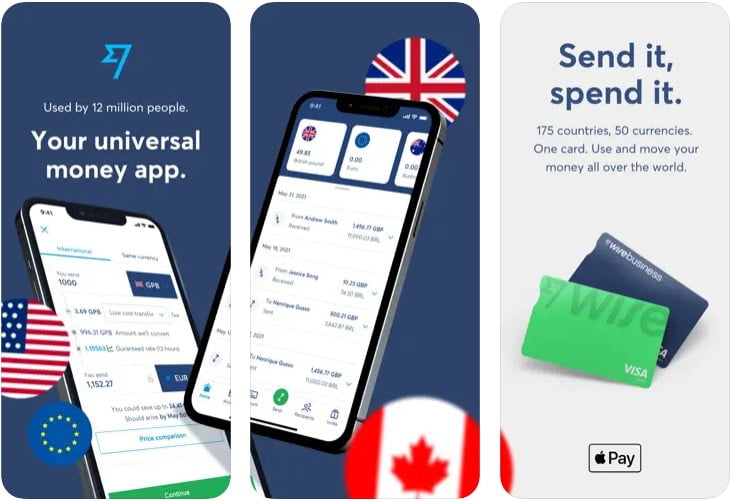

2. Wise (TransferWise)

Wise, formerly known as TransferWise, is a money transfer app that allows users to send money abroad without having to pay high fees. The app is simple to use and can be accessed on any device, making it the perfect choice for people who need to send money quickly and easily. Wise also offers a great exchange rate, meaning users can save a lot of money when using the app.

When you use Wise to send money abroad, the app will automatically find the best possible exchange rate for you. This means you can rest assured knowing you are getting the best deal possible. In addition, Wise charges a low fee for using its service, which makes it a great choice for people who want to save money on their transactions.

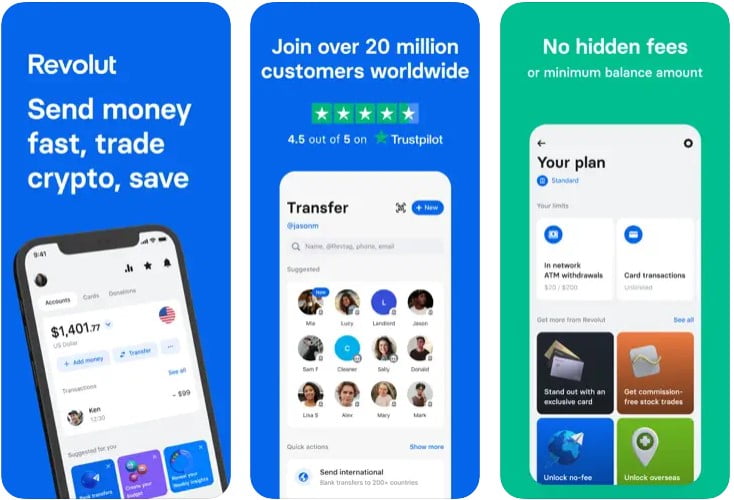

3. Revolut

The Revolut app is incredibly easy to use. Once you have registered for an account, you can quickly and easily exchange different currencies using the currency converter tool. You can also hold multiple currencies in your account anytime, making it perfect for traveling or doing business overseas.

Moreover, Revolut doesn’t charge fees for foreign transactions or ATM withdrawals made abroad. The only fee you’ll ever pay is 0.5% when exchanging between British pounds and euros (or other supported currencies). This makes Revolut one of the cheapest ways to send money abroad.

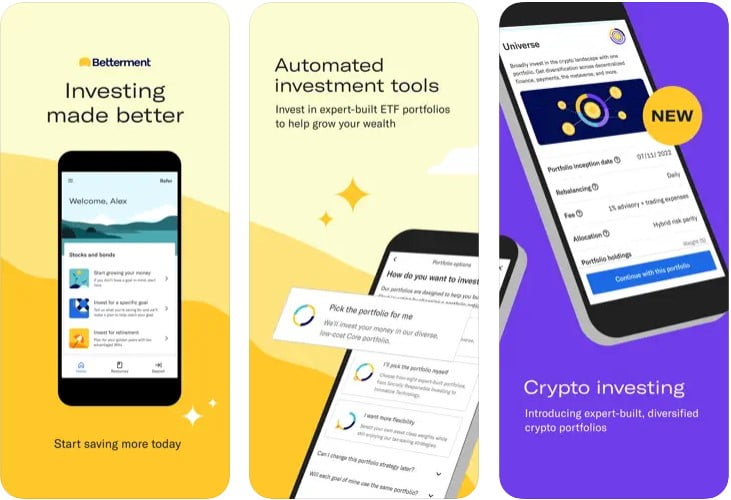

4. Betterment

Betterment is an online investment platform that makes it easy for anyone to start investing. There are no minimum investment requirements; you can start with as little as $5. Plus, Betterment offers a wide variety of investment options so that you can find the perfect portfolio for your needs. And because Betterment is online, you can access your account anytime, anywhere.

Betterment also offers some great features that make it easier than ever to invest your money. For example, Betterment will automatically rebalance your portfolio whenever it gets out of balance, which helps ensure that your investments stay on track over time. And if you ever have any questions or concerns, Betterment’s customer service team is always happy to help.

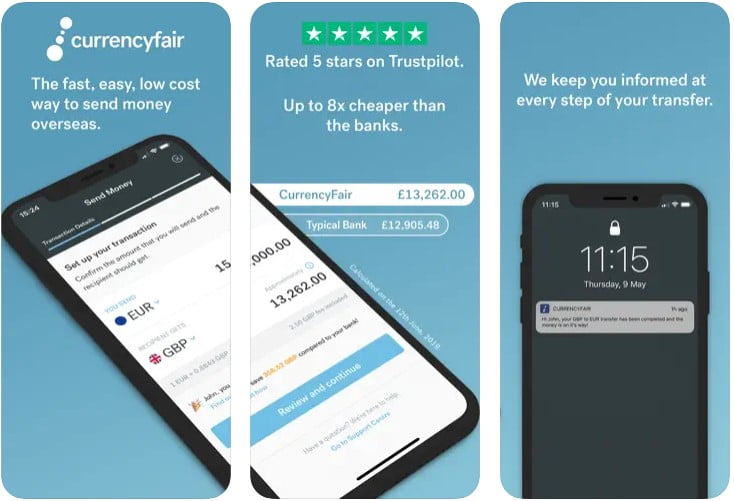

5. CurrencyFair

CurrencyFair is a Dublin-based startup that allows people to exchange currencies with one another. It was founded in 2009 by Jonathan Sugarman and Brett Meyers. The company received its first round of funding in 2010 from the Irish Technology Seed Fund. It has since raised more than $10 million in venture capital.

CurrencyFair allows users to exchange money with one another without having to go through a bank. This can save the user money on fees and time, as the process is typically much faster than going through a bank. CurrencyFair also guarantees that users will get the best possible rate at the conversion time.

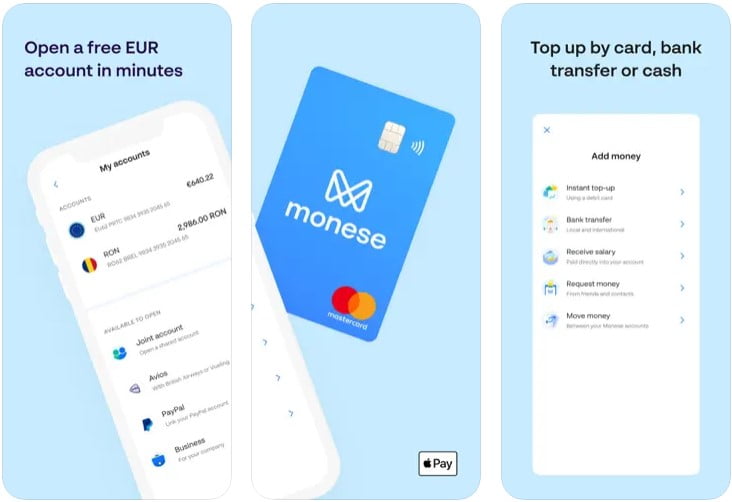

6. Monese

Monese is a mobile banking app that allows you to send and receive money and pay for things in shops and online using your phone. It’s one of the most popular apps of its kind, and it’s growing in popularity all the time. One of the main reasons for this is that Monese is incredibly easy to use – you can get started in minutes without going through a long and complicated sign-up process.

Monese also offers great value for money. There are no fees for making domestic transfers or receiving payments, and there are low fees for international transfers. In addition, Monese doesn’t charge any interest on overdrafts, which makes it a great choice for people who often find themselves running short of cash at the end of the month. If you’re looking for a simple and affordable way to send and receive money, Monese is worth checking out.

If you need to send money abroad quickly and easily, one of these three investment apps is your best bet: eToro, TransferWise, or Revolut. Each of these apps offers low fees and fast transfers, making them the perfect choice for anyone who needs to move their money quickly. So don’t hesitate to download one of these apps today and start sending money abroad easily.